随着2018年Q4的结束,新一轮的考试季正在布局中。我们的团队一直在努力工作,确保2019年的课程教材能够满足USCPA考试的更新.

众所周知,2019年Q1开始,USCPA考试又有变化,具体来说就是对AICPA蓝图的更改,以及对权威指南的更改导致的内容更新。

AUD,审计与鉴证

蓝图

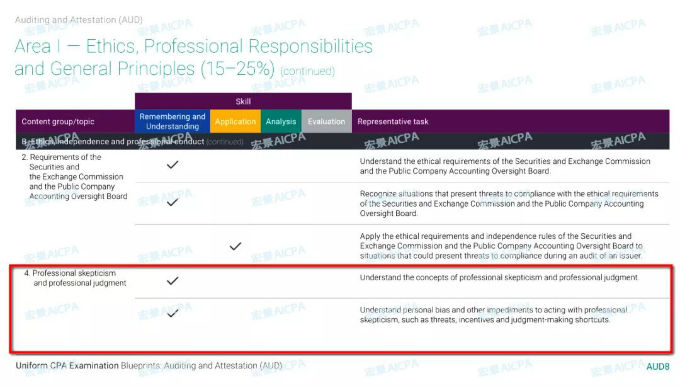

2019年AUD蓝图没有任何增加或删除的内容区域。但是,有一些修改,增加了关于职业怀疑主义的更多细节。更新不会改变AUD测试合规的内容性质或范围。

● 在引言部分增加了对专业怀疑主义的参考:

专业怀疑反映了一个迭代的过程,包括质疑的思维和审计证据的批判性评估等。这对公共会计实务和新注册会计师的工作至关重要。

● 在Area I ,B组增加话题 “Professional skepticism and professional judgment” 。

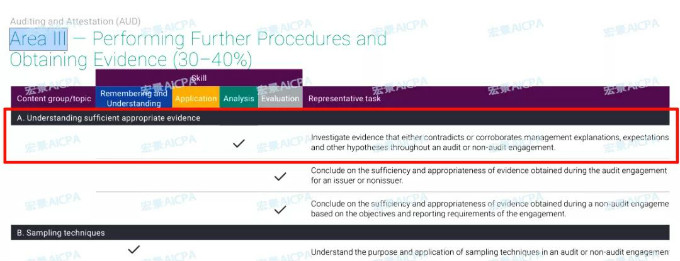

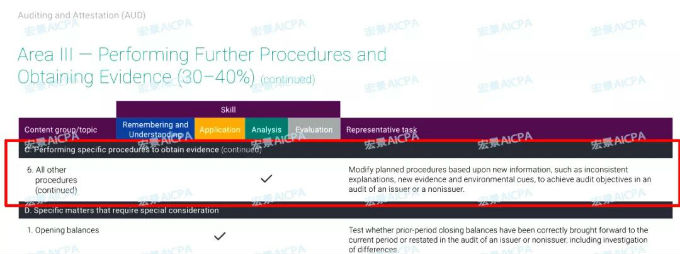

● 在Area III,A组,添加分析代表任务语句“Performing Further Procedures and Obtaining Evidence”

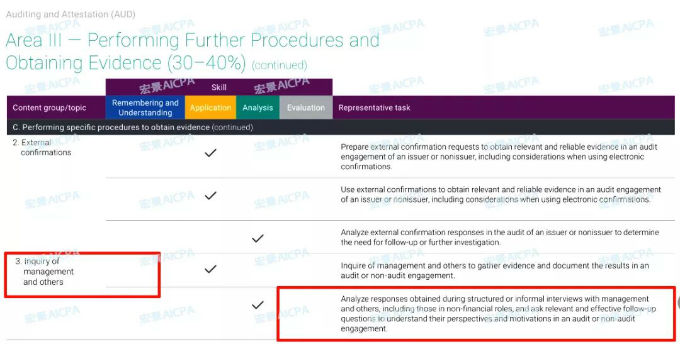

● 在Area III,C组,修订了话题3“Performing Further Procedures and Obtaining Evidence – Performing specific procedures to obtain evidence - Inquiry of management and others”

● 在Area III,C组,话题6添加了“Performing Further Procedures and Obtaining Evidence – Performing specific procedures to obtain evidence”

02

BEC,商业环境与概论

蓝图

2019年1月1日的BEC蓝图没有变化。目前正在评估BEC蓝图的Area IV,Information Technology。

03

FAR,财务会计与报告

蓝图

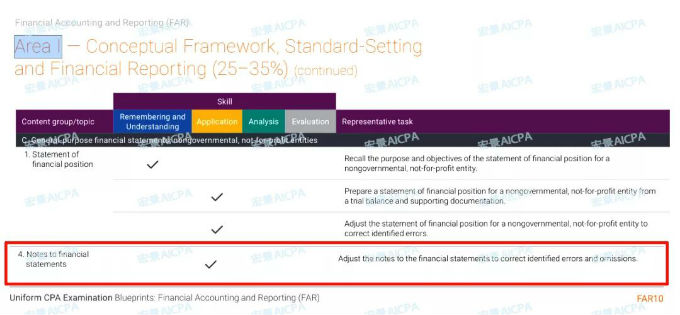

在Area I,C组,增加话题4“Conceptual Framework, Standard-Setting and Financial Reporting - General-purpose financial statements: nongovernmental, not-for-profit entities with the following application task statement”

这个变化是响应ASU 2016-14:非营利实体财务报表的陈述,该财务报表在2019年1月1正式测试。

04

REG,法律法规

蓝图

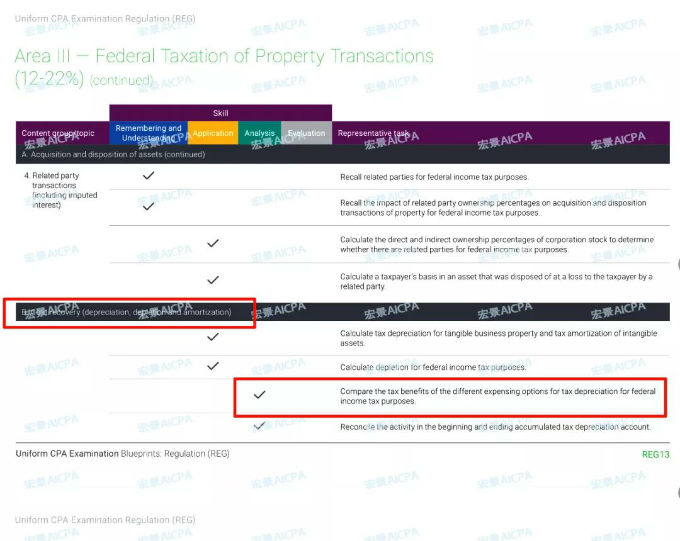

● Area III,B组 ,修正的现有分析任务语句 “ Federal Taxation of Property Transactions - Cost recovery (depreciation, depletion and amortization) ”

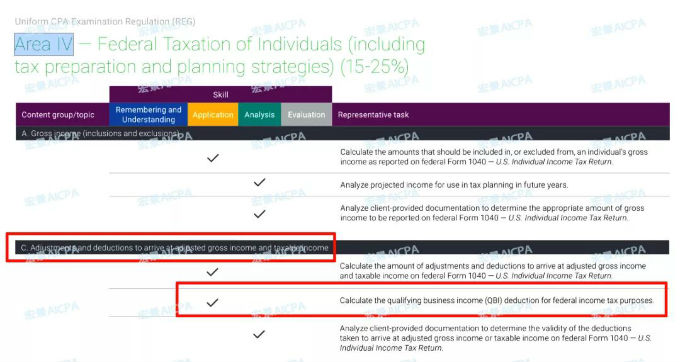

● Area IV,C组 ,增加应用程序代表任务语句“Federal Taxation of Individuals (including tax preparation and planning strategies) - Adjustments and deductions to arrive at adjusted gross income and taxable income”

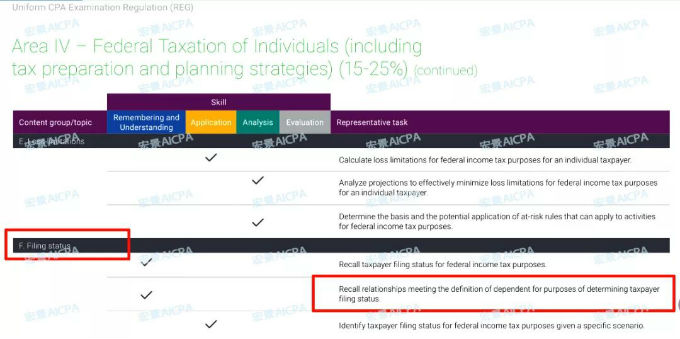

● Area IV,F组,删除了对个人豁免的提及“ Federal Taxation of Individuals (including tax preparation and planning strategies) - Filing status and exemptions, deleted two task statements on personal exemptions”并添加了新的记忆和理解任务说明。

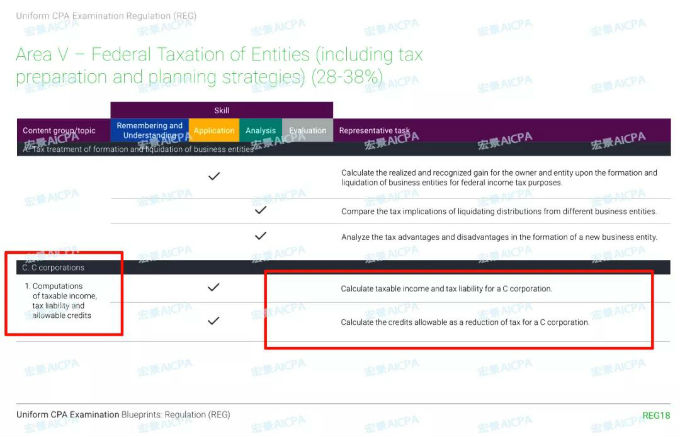

● Area V,C组,删除了对C公司备选最低税的提及,并删除了仅关注测试C公司备选最低税的任务说明“Topic 1 – Federal Taxation of Entities (including tax preparation and planning strategies) - C Corporations - Computations of taxable income”

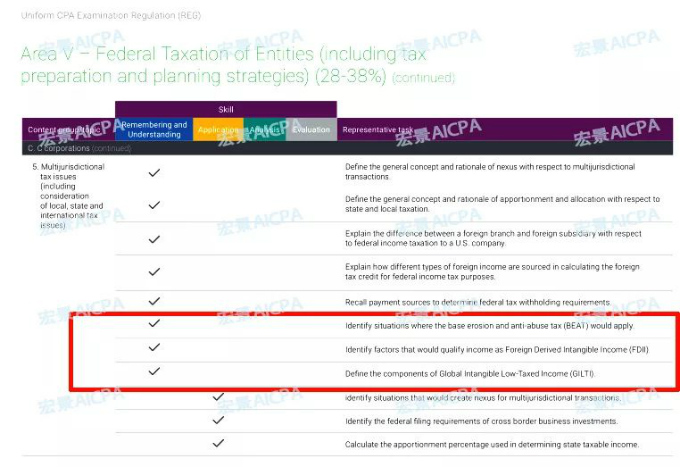

● Area V,C组,主题5 ,增加“Federal Taxation of Entities (including tax preparation and planning strategies) - C Corporations - Multijurisdictional tax issues (including consideration of local, state and international tax issues)”

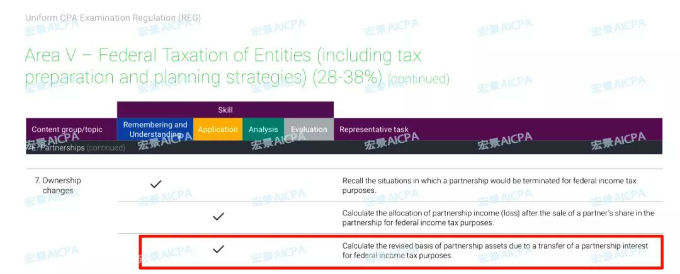

● Area V,第E组,主题7 ,修订了“Federal Taxation of Entities (including tax preparation and planning strategies) - Partnerships - Ownership changes”

来源:PrimeVest 宏景AICPA原创分享,转载请联系授权,未经授权禁止转载。文中图片来自于cpa-exam-blueprints-effective-jan-2019,版权归原作所有,如有侵权行为请联系删除。